Chugach Electric Submits Rate Case to RCA

By Brian Kassof

July 28, 2023

(Click here for the AETP article on the conclusion of the CEA rate case)

On June 30 Chugach Electric Association (CEA) applied to the Regulatory Commission of Alaska (RCA) to revise its rates. CEA’s proposal (also known as its “rate case”) includes two rate changes. One is an interim rate hike of 3 to 4 percent for most energy consumers that will go into effect on September 1. The second is a permanent set of rate changes that, if approved, would go into effect sometime before September 2024. (All rate changes in this story are based on current CEA rates and are not cumulative).

The permanent rate change would add an average of 5.8 percent to consumers’ current bills, but its impacts will vary considerably for different groups. For example, the average South District Residential consumer would see a 10 percent increase in their monthly bill. North District consumers would actually see their rates go down slightly under the proposed permanent rates. (Because this article is focused on CEA’s rate case, it does not take into account the impact that the end of the Restricted Rate Reduction (RRR) subsidy at the end of 2023 will have on North District consumers’ total bills). CEA’s South District encompasses the area it served prior to 2020; the North District is the area formerly served by Anchorage’s Municipal Power and Light (ML&P).

CEA has developed a web page with information about the rate case. It includes a bill calculator that allows people to see how the proposed interim and permanent rates will affect their monthly bill. There is also a Frequently Asked Questions (FAQ) section and a link to a June 19 webinar explaining how the rates were developed. CEA members or energy consumers wishing to comment to the RCA about the proposed rates have until August 4 to submit them. Full instructions for submitting comments to the RCA are included at the end of this article.

According to CEA, the rate increase is necessary for several reasons, including an on-going decline in sales and the impact of inflation. The rate increase is also designed to improve CEA’s equity position, which is below industry standards. The new rates will bring North and South District energy consumers under a single rate structure. CEA is adamant that the rate increases are not the result of its 2020 purchase of ML&P. It says that merging the two utilities’ operations has saved energy consumers tens of millions of dollars a year, and that rate hikes would be even higher if it had not bought ML&P.

The proposal includes two innovative features. One is an experimental Time of Use program that will feature different rates during peak hours (9 a.m. to 9 p.m.) and non-peak hours (9 p.m. to 9 a.m.). The program, which will be open to a limited number of members, is designed to see what impact time-specific rates will have on patterns of usage. The new rates also include a provision to provide shore power to cruise ships docked in Whittier.

Some CEA members and consumer advocates have raised questions about the proposed rates and how the rate case is being handled. One prominent line of criticism is that CEA should be designing a rate structure that would encourage the conservation of Cook Inlet natural gas. Some also wonder why the process was rolled out so quickly—CEA was required to submit the new rate plan to the RCA by August 15, 2023, but decided to push the date forward to June 30. Consumer advocates have also raised questions about how rate increases will impact certain groups of energy consumers.

A note on terminology. CEA is a cooperative, and everyone with their name on a bill is a member-owner. But not all people who receive power from CEA are members—many renters pay indirectly for CEA power. In recognition of this fact, this article uses the term consumer or energy consumer to indicate those who will be impacted by the proposed changes. The term member is used to refer specifically to the cooperative’s member-owners.

How Would the New Rates Impact Consumers?

CEA’s proposed rate changes would take place in two stages. The interim rates, which would go into effect on September 1, will affect everyone more or less equally. The impact of the permanent rate changes, which would take effect in 2024, will vary depending on several factors.

The first part of the proposed rate changes is a uniform 5.54 percent increase for Residential and Small Business consumers to the “energy charge” line on their bill. (In the case of large commercial members, the change will also be applied to their demand charge). This is one of several elements that determines the cost paid per kilowatt hour. Since the energy charge is only one element, albeit a significant one, of the overall bill, the bottom-line impact of this change will be between 3 and 4 percent for most consumers.

According to CEA, its current revenues are not sufficient to meet its needs, making the temporary increase necessary while the RCA considers its permanent request. In its filing CEA stated that anyone who ends up paying more under the interim rates than they will under the proposed permanent rates (as may be the case for some North District consumers—it is not clear how the RRR subsidy will factor into this) will have the difference refunded to them, in the form of a credit on their bill.

The second part of the proposed rate change—the permanent changes to basic rates that would likely take effect in September 2024--is far more complicated. While the overall impact will be an average increase of 5.8 percent to monthly electric bills, the actual effect on different consumers will vary depending on three factors: geographic area (North or South District); member class (Residential, Small Business, Large Secondary Commercial, Large Primary Commercial), and monthly usage.

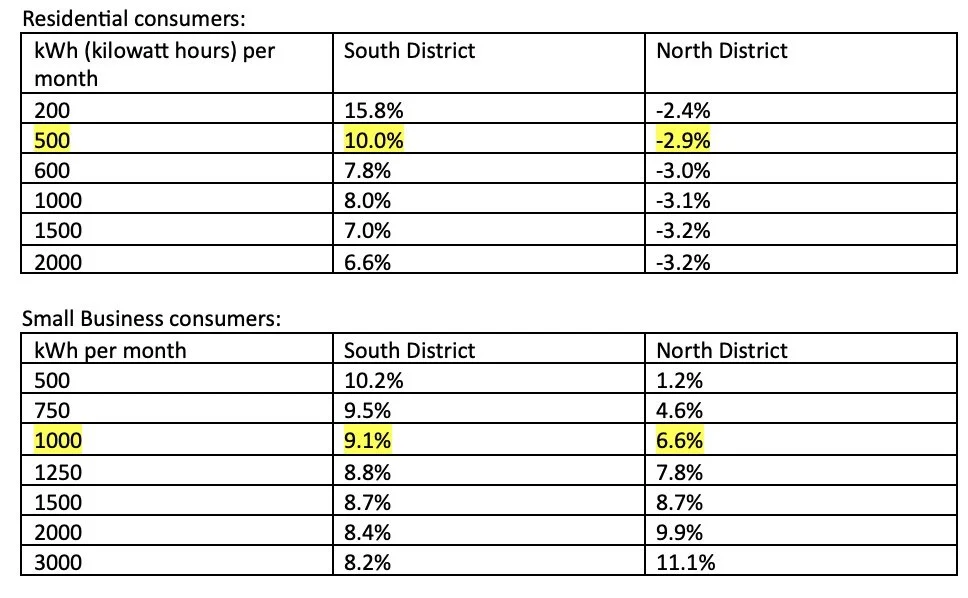

The tables below lay out the estimated impact of the proposed permanent rate changes on Residential and Small Business energy consumers in the two districts, with average use levels highlighted in yellow. Figures were calculated using CEA’s bill calculator. Figures for North District do not include the impact of the end of the RRR subsidy on 12/31/23.

As the charts demonstrate, the impact of the rate changes will vary considerably. Most South District Residential and Small Business consumers will see rate increases of 8 to 15 percent, while North District Residential consumers will actually see their rates drop slightly. The differences between the two districts is a reflection of the fact that North District consumers (former ML&P customers) are already paying higher rates than legacy CEA members.

The percentage rate increases for South District Residential consumers will be higher for those who use less power. This is because a substantial portion of the rate increase for this group will come in the form of a higher monthly customer charge, Under the proposed rate plan, it will go from $8 a month to $13.68 a month (a 71 percent increase—North District Residential consumers already pay a customer charge of $13.62, so they will see little impact from this change). This charge is applied to all residential consumers regardless of usage. The raised charge will account for about 40 percent of the anticipated cost increases for CEA’s Residential class.

When asked for comment, a CEA spokesperson said that CEA’s monthly customer charge has not been raised since 2006. She added that CEA believes its allocation of these charges reflects real costs and follows established rate design practices in Alaska. CEA has pointed out elsewhere that its new charge is in line with those of other Railbelt utilities—Matanuska Electric currently has a $13.00 monthly customer charge, Homer Electric $20.00, and Golden Valley Electric $22.50.

For the most part, the new rates are meant to reflect the actual cost of providing service to different customer classes. There are a few exceptions, however. Dr. Carl Peterson, a consultant with Concentric Energy Advisors who helped CEA develop its rate proposal, explained in the June 19 webinar that one of the utility’s goals was to avoid “rate shock”—an especially dramatic increase in rates for a specific group. Based on the cost study produced for the rate case, a true reflection of the cost of service would have required a 25 to 30 percent increase in the bills of South District Small Business members.

To prevent rate shock, the proposed rates shift some of the costs incurred by Small Business and Large Primary Commercial members onto other rate classes (mostly Residential and Large Secondary Commercial), to level out the impact of the increases. This cost-shifting accounts for about 15 percent of the proposed permanent rate increase for Residential consumers.

Innovative Features:

CEA’s proposal includes a couple of new programs. One is a pilot “Time of Use” program that will charge members different energy rates depending on the time of day. Those participating in the program will be charged at a higher rate for power used during the hours 9 a.m. to 9 p.m., and a lower rate for power consumed from 9 p.m. to 9 a.m.—the evening rate will be half the daytime rate. The goal of such programs is to encourage members to shift their electric usage to a time of day when commercial use is lower, to help even out system demand.

The program will be open to 500 Residential members and 500 Small Business members (rates for the two groups will be slightly different). If the program is approved by the RCA, members interested in participating would be able to apply in the fall of 2024. The program will run for five-and-a half-years, from January 2025 to June 2030. Some of those participating will be randomly selected to receive smart thermostats for their home or business. Members using net-metering would not be eligible for the program.

CEA is also asking for permission to offer power to cruise ships docked at Whittier. These ships currently idle their engines while in port to produce shipboard power, creating poor local air quality. The program would be subject to negotiation with the cruise lines. If approved, the program could also be extended in the future to recharge electrically-powered cargo ships (still in the experimental stage) at the Port of Alaska or to provide similar services to other ships docked in the CEA service area.

Criticisms and Questions:

CEA members, along with consumer and renewable energy advocates, have raised concerns about several aspects of the proposed plan. These include its failure to encourage conservation of dwindling supplies of Cook Inlet natural gas, the way costs are distributed among different users, and its potential impact on consumers’ budgets. The Renewable Energy Alaska Project (REAP) has signaled its intention to challenge parts of the rate plan when it comes before the RCA.

Energy economist and policy analyst Antony Scott believes that CEA is squandering a key opportunity to encourage the conservation of Cook Inlet natural gas. Scott has worked in various parts of the Alaskan energy sector for decades, including as an RCA economist and later as an RCA Commissioner. Although Scott currently works for REAP, he spoke to AETP on his own behalf as a CEA member.

Scott pointed out that CEA relies on natural gas for about 80 percent of its power generation and that supplies of Cook Inlet natural gas are expected to fall below demand by 2027. CEA, which owns a portion of the Beluga River gas field, may be able to delay the exhaustion of its local gas supply for several additional years, but even it will face shortages by 2030. It will then need to import natural gas at much higher prices (even if an in-state pipeline were built, it would not be ready for years). CEA’s own financial projections reflect this—they predict that when they can no longer meet demand through locally purchased gas and production from Beluga River (which they estimate will be by 2031), their fuel costs will double, leading to a predicted 15 percent rate increase between 2030 and 2031.

Given this reality, Scott believes that CEA should be doing everything possible, including using rate design, to incentivize conservation in order to slow the drawing down of low-cost Cook Inlet gas supplies. He also pointed out that the state statute governing rate design lists “conservation” as a primary objective.

The simplest way for CEA to encourage conservation, he said, would be through the introduction of a tiered pricing system based on energy usage (sometimes known as Inverted Block Rates). This is a system where consumers pay one rate per kilowatt hour up to a certain amount of monthly usage, then a higher rate (or rates, depending on the number of tiers) for additional power—this imposes a cost for higher energy use, encouraging conservation.

Along the same lines, Scott believes CEA could use innovative rate design to encourage other steps that would preserve gas supplies, such as encouraging more people to install rooftop solar arrays through changes to the net-metering program (net-metering allows members with solar arrays to sell excess power back to a utility). If anything, Scott believes the current rate proposal actually discourages the adoption of rooftop solar by excluding net-metering members from participation in the Time of Use pilot program.

Scott also had questions about rate equity. He pointed out that increases in monthly customer charges have a disproportionate impact on those who use less power. Scott is also not sure if the proposed rates treat North and South District consumers fairly. The RCA order allowing the ML&P deal specified that revenue requirements be apportioned between the North and South Districts based on their load share (the total kilowatts hours used). Scott said that CEA’s rate filing does not address this condition, and, given the cost-shifting between user classes to avoid rate shock, may very possibly be in violation of it.

A number of CEA members, including Scott, spoke at May and June board meetings asking that CEA delay its filing of the rate case, so that issues of conservation could be considered. They criticized the utility and its Board of Directors for not doing more to listen to members’ concerns and interests in the rate design process. Although CEA took steps, such as the June 19 webinar and the Rate Case webpage, to educate members about the change, they do not feel the Board engaged in a real dialogue with members.

At the June 21 meeting of the CEA Board’s Operations Committee, board members and staff acknowledged that, by the time the details of the rate case were shared with members, the process was already too far advanced for any substantial changes before filing. They also stressed that the early filing was necessitated by “financial performance concerns.” As CEO Arthur Miller explained, the utility needs an interim rate increase as soon as possible to account for costs and to build a bigger financial cushion so it can cope with potential emergencies (such as disruptions due to a storm). Higher revenues are also needed to meet the conditions of some of CEA’s loans. (Audio of the meeting is available here).

The CEA Board did include a clause in its June 28 Resolution approving the submission of the rate case that requires Miller to investigate “alternative rate programs and designs” that encourage decarbonization and beneficial electrification, and to report back to the Board by June 2025. (Decarbonization and beneficial electrification refer to strategic goals set by the CEA Board). However, Miller made it clear at the June 21 Operations Committee meeting that he believed that possible innovative rate designs emerging from this process would need to be tested in limited pilot programs (like the Time of Use program), which means they would not impact overall rate design for many years.

In response to criticism about CEA’s failure to propose a rate design that does more to conserve natural gas supplies, a spokesperson for the utility said that the primary goals of the rate case were to provide a unified rate structure and to mitigate the impact of rate changes on different customer classes. She added that, if the Time of Use program is successful in shifting load away from peak times, it will allow CEA’s gas turbines to work more efficiently, reducing the amount of gas used. It is not clear how much impact this will have before 2030, given the relatively small size of the program (about one percent of Residential and Small Business members).

Consumer advocates have also raised some concerns about the size of the increase. Veri di Suvero, Executive Director of the Alaska Public Interest Research Group (AKPIRG), told Alaska’s News Source that the proposed rate hike could have a “huge impact” on low-income households’ budgets, and hoped that the RCA would take this into account when reviewing the proposal.

[In the interest of full disclosure. AKPIRG provides funding for AETP, and is an institutional member of REAP. AETP is fully editorially independent from AKPIRG.]

Why is Chugach Asking to Change Its Rates?

For its part, CEA says the rate increases are necessary and justified. In the FAQ section on its Rate Case page, the utility lays out its reasons for filing a rate case and why the proposed increases are justified. One is to account for a combination of slightly declining demand and rising costs due to inflation. CEA also needs to increase its equity levels, which fell well below recommended levels after the completion of the ML&P deal.

Finally, the creation of a unified rate structure for North and South District consumers by 2023 was a condition for RCA approval of CEA’s purchase of ML&P. CEA was given a three-year period to consolidate and integrate the operations of the two utilities, with a deadline of December 2023 to file a unified rate structure (which was modified to August 15 last year, and then advanced by CEA to June 30).

According to CEA, the main reason for raising rates is because their revenues are simply not keeping pace with expenses. CEA, like most Railbelt utilities, has seen a slight but steady decline in sales since 2011. While some costs, like fuel, fluctuate with power demand, others, like administration and maintenance of power plants and transmission lines, are fixed. Lower sales mean that a higher proportion of fixed costs must be recovered for every kilowatt hour sold. According to CEA, this trend, together with the impact of recent inflation, require rates being adjusted upward.

Higher rates are also necessitated by CEA’s equity position. Equity measures the relationship between a company’s assets and liabilities (expressed in the form of a percentage). Based on industry standards, CEA should optimally have an equity level of about 35 to 40 percent (meaning that its liabilities are no greater than 60 to 65 percent of its total assets)—this was a figure that CEA and the RCA agreed upon in 2019. CEA’s equity level was at 30 percent before the ML&P purchase. Because of the debt taken on to finance this deal (CEA issued about $800 million in bonds in 2020 for this purpose), its equity level fell below 15 percent, and has remained low (it currently stands at about 16 percent).

Low equity has a negative impact on a business’ ability to borrow money; lenders will demand higher interest rates and bond-rating companies will downgrade their ratings. It also means a business has less cash available in case of an emergency or to undertake capital projects.

The new rates will give CEA higher operating margins, which will allow it to build its equity. Operating margins are the amount a cooperative earns over its expenses. Since electric utilities like CEA are monopolies, their margins are closely regulated by the RCA. As part of its rate case, CEA is asking to have its maximum operating margin—the percentage of revenues it can collect over its costs—increased from 1.35 percent to 1.75 percent. (CEA currently has a separate operating margin for distribution, but this will be eliminated). This change, which is built into the new rates, will allow CEA to increase its revenue over expenses from roughly $8 million a year to about $35 million a year in 2025 (with the amount declining in subsequent years). At this rate, they anticipate reaching 35 percent equity by 2033.

It should be noted that because CEA is a cooperative, its revenue over expenses is not considered “profit”—instead, it is viewed as a form of capital loaned to the cooperative by members to cover unexpected expenses, fund new projects, and maintain equity levels. If a portion of this money is not used for these purposes after a number of years (usually between 15 and 25, though this can vary considerably depending on a number of factors), it will be returned to the cooperative’s members (this is known as retiring capital credits).

As discussed above, immediate concerns about CEA’s finances lay behind the request for an interim rate increase. This increase is designed to keep CEA’s operating margins in 2023 and 2024 at the same level they have been for the last few years, at about $8 million a year. As mentioned earlier, concerns about CEA’s current operating margin were the reason it submitted its new rates to the RCA six weeks ahead of the August 15 deadline, so it would be able to start collecting the new rates sooner.

CEA is eager to head off criticism that it is breaking its promise not to raise rates due to the ML&P purchase--this is Point 2 in its Rate Case FAQ. According to CEA, not only are the proposed rate increases not a result of the merger, but the rate increase would have been even higher if the two utilities had not merged. According to CEA filings with the RCA, it has saved at least $72 million overall since 2020, with the main savings in fuel, personnel, and information services. This has led to lower rates for the past three years, and it anticipates continued savings in the future.

The actual savings may be somewhat lower, however—the RCA is allowing CEA to amortize many of the integration costs associated with the merger over a 21-year period, meaning that many of these expenses have not yet appeared on CEA’s balance sheet. It also does not account for the fact that CEA’s need to rebuild its equity is, at least in part, a result of the debt taken on to acquire ML&P. CEA’s equity position since 2020 has also been affected by its decision to set its operating margins at 1.2 percent, below the limit of 1.35 percent set by the RCA. This was done, at least in part, in order to demonstrate to consumers that the ML&P purchase was not affecting rates.

Next Steps:

The filing of the rate case with the RCA on June 30 is just the first step in a long process. The RCA will accept public comments on CEA’s proposal until August 4. It will then hold a hearing by August 17 to determine what happens next. At that point, the RCA will rule on the proposed interim and permanent rates. Unless it finds some serious problem with the filing, the RCA will almost certainly approve the interim rates, which would go into effect on September 1.

It is equally likely that the RCA will suspend the permanent rate proposal and open an investigation. This is standard RCA procedure—the term investigation does not imply any wrongdoing on CEA’s part. It means that the RCA requires additional information to determine if the proposal conforms with Alaska State statute and RCA rules. It also provides an opportunity for other interested parties to intervene on their own behalf or in the public interest. REAP has already signaled its intention to apply for intervenor status and to challenge the new rates on the grounds they do not encourage conservation of resources. The Regulatory Affairs and Public Advocacy section of the State Attorney General’s Office (RAPA) will also likely be invited to represent the public interest. Other potentially interested parties might include other utilities, power suppliers, or large CEA commercial customers.

This will kick off a long period of legal filings and the collection of evidence and testimony by the interested parties, which will be overseen by an Administrative Judge. Then the RCA staff and Commissioners will review the accumulated materials and issue an order on the proposed rate changes—this must occur within 450 days of their original submission. Since the rate case was submitted June 30, 2023, the matter must be decided no later than September 22, 2024. There are three possible outcomes to the case. The RCA can approve the new rates as submitted, approve them with modifications, or reject them entirely and require CEA to file an entirely new rate proposal.

What is Meant by a “Rate Case”?

The language around CEA’s proposal can be a little daunting. Technically CEA has submitted three things to the RCA—a revenue requirement study, a cost-of-service study, and a new rate design, which are collectively referred to as a “rate case.”

The revenue requirement study uses a test year (2022) to determine how much income CEA needs to provide service in a given year. The cost-of-service study then allocates these costs to functional categories (generation, transmission, distribution, administration and member services) and customer classes. Together these two studies define the utility’s annual revenue needs and how these should be divided up among different types of consumers. This provides the basis for the rate design—the establishment of new rates that fairly allocate costs among user classes.

People may also see reference to CEA’s tariff. A tariff lays out what services a utility provides, who is eligible to receive them, and how much they cost. All Alaskan utilities regulated by the RCA must have their tariffs approved by that body. In technical terms the rate case is a major revision to CEA’s existing tariff, which is why it is identified by the RCA as a tariff matter.

How to File Comments with the RCA:

Unfortunately, the system for filing comments with the RCA is a bit cumbersome. If you follow the link on CEA’s Rate Case page, you will be taken to the RCA’s Public Notices Page. Once there, you will need to scroll down the column labeled “Matter Number and Description” to the CEA rate case notices. There is one for the North District (TA422-121) and one for the South District (TA544-8). Both were posted on 7/7/23. If you are a CEA consumer, you may want to select your district, although either will work.

If you go to the far right column, you will see a link labeled “Submit Comments.” Click on that—you will then be walked through a four-step process for filing. You will be able to upload written statements as part of the process. Please be aware that all comments submitted to the RCA are public records and are available for viewing (there is a link to “View Submitted Comments” in the far right column if you wish to see other submissions).